Friday, March 15, 2013

9 Mistakes Homeowners Make on their Taxes

As you calculate your tax returns, consider each home tax deduction and credit you are — and are not — entitled to. Running afoul of any of these 9 home-related tax mistakes — which tax pros say are especially common — can cost you money or draw the IRS to your doorstep.

As you calculate your tax returns, consider each home tax deduction and credit you are — and are not — entitled to. Running afoul of any of these 9 home-related tax mistakes — which tax pros say are especially common — can cost you money or draw the IRS to your doorstep.Sin #1: Deducting the wrong year for property taxes

You take a tax deduction for property taxes in the year you (or the holder of your escrow account) actually paid them. Some taxing authorities work a year behind — that is, you’re not billed for 2013 property taxes until 2014. But that’s irrelevant to the feds.

Enter on your federal forms whatever amount you actually paid in 2013, no matter what the date is on your tax bill. Dave Hampton, CPA, tax manager at the Cincinnati accounting firm of Burke & Schindler, has seen home owners confuse payments for different years and claim the incorrect amount.

Sin #2: Confusing escrow amount for actual taxes paid

If your lender escrows funds to pay your property taxes, don’t just deduct the amount escrowed, says Bob Meighan, CPA and vice president at TurboTax in San Diego. The regular amount you pay into your escrow account each month to cover property taxes is probably a little more or a little less than your property tax bill. Your lender will adjust the amount every year or so to realign the two.

For example, your tax bill might be $1,200, but your lender may have collected $1,100 or $1,300 in escrow over the year. Deduct only $1,200. Your lender will send you an official statement listing the actual taxes paid. Use that. Don’t just add up 12 months of escrow property tax payments.

Sin #3: Deducting points paid to refinance

Deduct points you paid your lender to secure your mortgage in full for the year you bought your home. However, when you refinance, says Meighan, you must deduct points over the life of your new loan. If you paid $2,000 in points to refinance into a 15-year mortgage, your tax deduction is $133 per year.

Sin #4: Misjudging the home office tax deduction

This deduction may not be as good as it seems. It’s complicated, often doesn’t amount to much of a deduction, has to be recaptured if you turn a profit when you sell your home, and can pique the IRS’s interest in your return. Hampton’s advice: Claim it only if it’s worth those drawbacks. If so, here’s what to know about what you can write off.

Sin #5: Failing to repay the first-time home buyer tax credit

If you used the original home buyer tax credit in 2008, you must repay 1/15th of the credit over 15 years. If you used the tax credit in 2009 or 2010 and then sold your house or stopped using it as your primary residence, within 36 months of the purchase date, you also have to pay back the credit.

The IRS has a tool you can use to help figure out what you owe.

Sin #6: Failing to track home-related expenses

If the IRS comes a-knockin’, don’t be scrambling to compile your records. Many people forget to track home office and home maintenance and repair expenses, says Meighan. File away documents as you go. For example, save each manufacturer’s certification statement for energy tax credits and lender or government statements to confirm property taxes paid.

Sin #7: Forgetting to keep track of capital gains

If you sold your main home last year, don’t forget to pay capital gains taxes on any profit. You can exclude $250,000 (or $500,000 if you’re a married couple) of any profits from taxes. So if your cost basis for your home is $100,000 (what you paid for it plus any improvements) and you sold it for $400,000, your capital gains are $300,000. If you’re single, you owe taxes on $50,000 of gains. However, there are minimum time limits for holding property to take advantage of the exclusions, and other details. Consult IRS Publication 523.

Sin #8: Filing incorrectly for energy tax credits

If you made any eligible improvements in 2012 — or will in 2013 — such as installing energy-efficient windows and doors, you may be able to take a 10% tax credit (up to $500; with some systems your cap is even lower than $500). But keep in mind, it’s a lifetime credit. If you claimed the credit in any recent years, you’re done. Fill out Form 5695.

The first part of the form, which covers systems eligible for a larger tax credit through 2016, such as geothermal heat pumps, can be complex and involves crosschecking with half a dozen other IRS forms. Read the instructions carefully.

Sin #9: Claiming too much for the mortgage interest tax deduction

You can deduct mortgage interest only up to $1 million of mortgage debt, says Meighan. If you have $1.2 million in mortgage debt, for example, deduct only the mortgage interest attributable to the first $1 million.

This article provides general information about tax laws and consequences, but shouldn’t be relied upon as tax or legal advice applicable to particular transactions or circumstances. Consult a tax professional for such advice.

Thursday, March 14, 2013

Tuesday, March 12, 2013

Monday, March 11, 2013

Monday Morning Special

Having a latte this morning? If you were at SXSW (Annual music, film, and interactive conference and festival held in Austin, Texas) you could get one with your portrait on it. If you wanted.

Sunday, March 10, 2013

5 Reasons Selling A Home Now Makes Sense

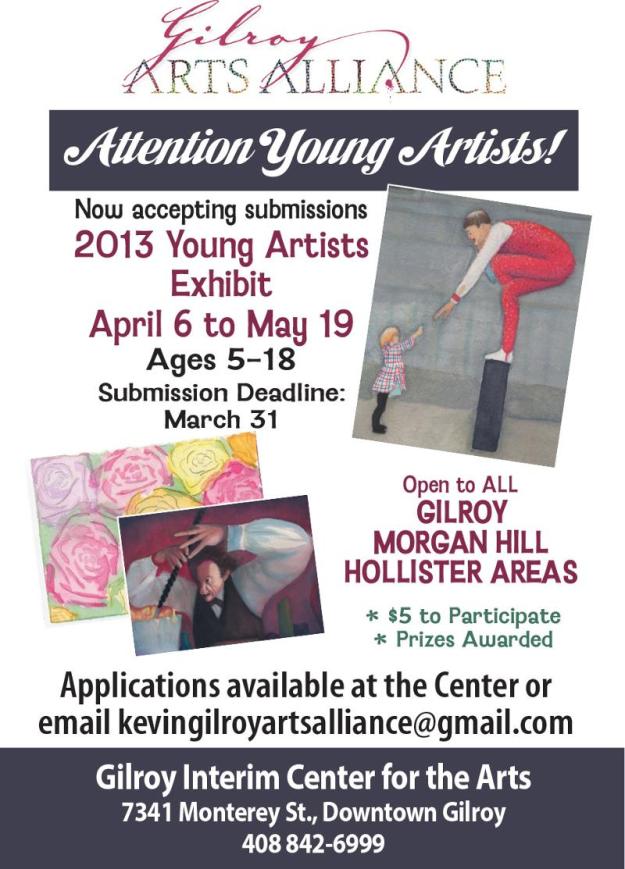

Many California homeowners are currently waiting to put their home on the market. The thought process usually involves traditional thinking that everything always looks best when the grass is green and flowers are in bloom. A home will surely be easier to sell if that is the case.

This is true, but your competition will also be using the same logic. Every year people wait until Spring to put their homes on the market. All at once there will be an influx hitting the MLS. In Gilroy there are compelling reasons why now is the time to get your home ready sooner rather than later. Here are five reasons why you should list your Gilroy home for sale now:

- Home Inventory at Record Lows - The inventory of homes for sale in the area have dropped substantially over the last six months. The number of homes for sale in most communities has fallen to lows we have not seen for many years. When home inventory levels drop home prices tend to rise, and that has certainly been the case in Gilroy. This becomes even more prevalent in a popular neighborhood where buyer competition is high. Many times there are bidding wars. We have already started to see this trend on homes hitting the market now.

- Demand is Up - Contrary to what some people may think there are lots of buyers out in the market place right now looking for a home to buy, and having their financing all lined up and ready to place. Some are first time buyers who are looking for a place to build some equity. There are others who see an opportunity to move up in the market as home prices have dropped substantially since the market peak in 2005.

- Renting vs. Buying - The cost of renting versus buying a home has become the same and in some cases it is actually less expensive to buy a home. Rents in many areas have steadily increased over the last five years while home prices have dropped. If you factor in the potential benefits of building equity and some tax breaks with home ownership, you can see why it makes sense.

- Interest Rates Going Up - Interest rates are at record lows at the moment and most economists predict they won’t stay that way for too much longer. While interest rates are not predicted to move up dramatically, every time they inch up a half a point they can knock out a percentage of first time home buyers out of the market. The first time buyers fuel the rest of the market like dominoes.

- New Construction Coming Back - Builders are starting to get back into the fray. When builders are actively building homes it becomes harder for some who are selling their used homes to compete. There are many that will jump at the chance to have a shiny new home with all the bells and whistles customized to their specific needs.

In summary, if there are no time constraints on your part you should consider moving up your timeframe for putting your home up for sale. Our Gilroy market is extremely hot. Morgan Hill is the same, and Hollister is very close behind. Get ahead of the Summer competition and list your home for sale today. Contact Team Patereau to talk about the right price and the right time to sell your home.

Labels:

List real estate,

local,

Sell real estate,

selling,

short sale

Subscribe to:

Comments (Atom)