A video preview of The Intero Insider:

By Gino Blefari, President & CEO, Intero Real Estate Services, Inc.

The end of the year is upon us. It’s been a good ride! Following is a rundown of the top 10 stories in real estate that made our list this year:

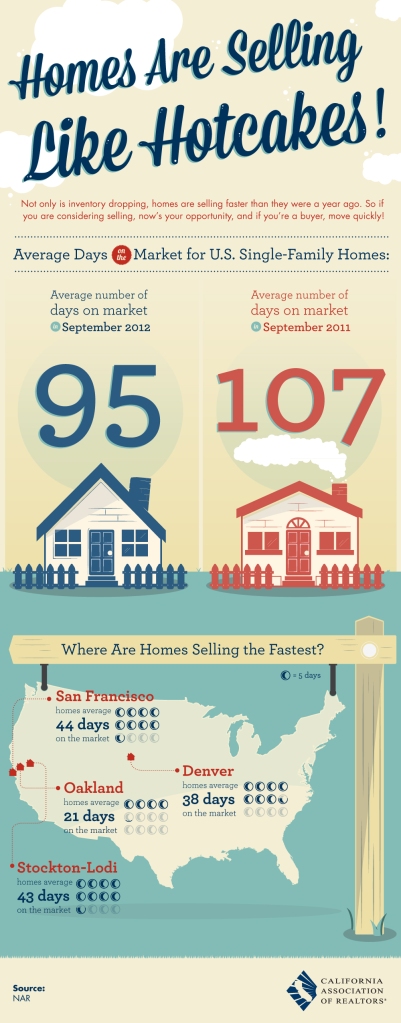

1. Home prices pick up. Home prices have been on an upward trek this year, fueled by strong demand, low interest rates and constrained supply in many markets. The most recent report year-end from Lender Processing Services showed a 3.6% increase in the home price index from a year ago. We expect the story to continue this way next year.

2. Foreclosures take a tumble. Total foreclosure inventory has fallen 9% this year, according to the latest report from CoreLogic, a good indicator of improving conditions. The number of foreclosures completed in October slipped to 58,000 from 77,000 in September and 70,000 a year ago.

3. Stellar year for Silicon Valley. We were fortunate enough to have some of the strongest housing markets in the country in 2012. In particular, Los Altos, Palo Alto and Burlingame showed the strongest comebacks this year with home prices just several percentage points away from peak levels in 2008, according to DataQuick. We expect this to continue in 2013 as our tech-fueled economy continues to flourish.

4. Housing in with Millennials. Many have speculated that the Millennial generation – 18 to 34 year olds – don’t have the voracious appetite for homeownership that previous generations have had. A recent survey showed differently as 72% of young adults said owning a home was part of their personal dream, and 43% are already homeowners.

5. Bidding wars back in vogue. The tight inventory across markets has created multiple bidding situations for buyers once again. This has been good for sellers, but obviously frustrating for buyers. The indirect effect of course will be good, though. Multiple bids help to push prices up, which can

help pull homeowners off the fence and get more sellers back in the market next year.

6. Borrowers more creditworthy. After the recession hit, lending standards tightened up considerably, which made it difficult for folks with credit problems to get home loans. The good news out of this has been that apparently borrowers got the message, and have improved their situations. Borrower creditworthiness in 2012 reached the highest in 12 years.

7. Mortgage interest deduction remains a hot issue. As Congress struggles to reduce the national debt, tax break programs are constantly on the table for potential cuts or eradication. The Mortgage interest deduction has been no exception. So far, with help from housing industry lobbyists like the National Association of Realtors, we’ve staved off any cuts. But we’re likely to hear more on this next year.

8. Interest rates at unbelievable lows. Rock-bottom interest rates have enabled a ton of refinance activity this year. Average rates on a 30-year fixed-rate mortgage will end the year below 4%. The Federal Reserve has indicated they’ll continue to keep short-term rates low, which means we’ll continue to see attractive rates for mortgage borrowers next year.

9. The “underwater” story improves. Throughout the recession and recovery, we’ve heard endless stories about the number of homeowners across the country that are underwater, or owe more on their mortgages than their homes are worth. The issue is significant when we talk about housing recovery because underwater owners often can’t sell and absent that option, markets have already started seeing problems with lack of available inventory to new buyers. The good news, though, is that it’s gotten a lot better this year.

10. Dealing with housing data conflict. Even a light tread through housing news can often lead you confused. Conflicting headlines are a regular thing. It’s important to understand the context around the data, the sources and how to interpret its impact or lack thereof on your own personal housing decisions.

There you have it. Overall, 2012 has been a great turning point in housing. We look forward to bringing more commentary and context to the discussion next year.

Happy New Year!

Real estate transactions aren’t like they used to be 20 years ago. Or 10 years ago. Or even 3 years ago. Today’s sellers often list their property slightly under the current market value, which encourages interest and activity and brings in multiple offers, many times over list price, and many time over the current market value. It’s a strategy that can be used on certain properties.

Real estate transactions aren’t like they used to be 20 years ago. Or 10 years ago. Or even 3 years ago. Today’s sellers often list their property slightly under the current market value, which encourages interest and activity and brings in multiple offers, many times over list price, and many time over the current market value. It’s a strategy that can be used on certain properties.